Quarter in Review

The first quarter of 2023 has been full of surprises — from dramatic swings in economic data to the sudden onset of a banking crisis, it has been a wild ride.

Markets came roaring out of the gates to start the year, primarily animated by a narrative that a Fed pivot from raising interest rates was on the horizon. This prompted a bullish enthusiasm for risk assets that had been beaten down over 2022, especially tech stocks, which helped power the NASDAQ to one of its best Januarys since its inception.

Then came a slew of economic data in February that showed more robust growth and a possible second wave of inflation, and markets promptly sold off on heightened fears that central banks in both the U.S. and Europe will have to push interest rates higher, and possibly keep them there longer. This set the stage for Fed Chair Jerome Powell’s Senate Banking Committee testimony at the beginning of March, where his comments caused futures to jump in the days that followed to a 70% likelihood that the Fed would increase rates by an additional 50 basis points at the FOMC meeting (March 21-23).

Then, banks began to collapse. Silvergate Bank’s demise was swiftly followed by a “run” on Silicon Valley Bank, followed by the closing of Signature Bank by New York State regulators, punctuated by Credit Suisse’s failure in Europe. Finally, governments stepped in, backstopped depositors, and the run on banks was halted (for now).

The Fed did raise rates, but only by 25 bps. Despite the chaos, markets managed to rebound, and the S&P 500 finished the quarter with a gain of 7.5%, the DJIA finished up 2.08%, and the tech-heavy Nasdaq posted a healthy increase of 17.05%.1

Bonds, which had a historically bad year in 2022 as interest rates spiked, rebounded over the first quarter in a flight to quality. This was particularly true for shorter-term U.S. Treasuries — the 2-year Treasury posted the best monthly return since 2002, up a strong 1.68% in March. In addition, the Bloomberg U.S. Aggregate Bond Index, or the “Agg,” finished up 2.96% quarter. At the same time, the Bloomberg Global Aggregate Index, representing bonds from developed and emerging markets, ended up 3.01% for the quarter.2

What’s Been Driving Markets – Inflation, Banks and Tech Stocks

-

Inflation

At the end of last year, rolling in January, market participants gravitated around the narrative that price pressures were on a steady glide path downward, and a soft landing was in sight. The higher-than-expected January CPI number and other economic data, including a monster jobs report in January and higher-than-expected Retail Sales and U.S. Producer Prices reports, served as a poignant reminder that the crowd often gets ahead of the data (often with unpleasant consequences).Since then, the Fed has focused on a narrower measure of the price of services excluding energy and housing, dubbed “supercore inflation,” to guide interest-rate policy. Unfortunately, this measure of inflation is still elevated and potentially moving in the wrong direction, suggesting the Fed will continue with the most aggressive tightening cycle in decades and potentially leave rates elevated for longer than many market participants anticipate.3

-

Banks

Bank failures roiled markets in March and hammered niche segments of the economy. Silvergate Bank underpinned almost every American crypto company. Silicon Valley Bank was home to cash belonging to half of all venture-backed startups in the U.S. Signature Bank was a more minor but still crucial crypto-friendly bank. The rapid-fire collapse of these banks had the potential to destabilize the financial system until Federal regulators — the Fed, Treasury Department, and other agencies —announced that all customers would have access to their money by enacting a “systemic risk exception,” allowing FDIC to use the Deposit Insurance Fund to ensure those with more than $250,000 would not lose any of their deposits. While there continue to be reverberations across the banking sector, these steps have calmed markets.4 -

Tech Stocks

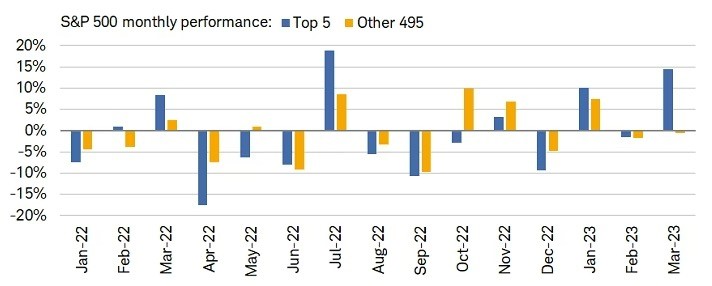

Markets have shrugged off the banking crisis and stubborn inflation to end the first quarter up. However, as you can see in the chart below, the lion’s share of market return has been driven by a handful of names. For instance, the ten largest stocks in the S&P 500 have been responsible for 90% of the overall return through the end of the first quarter.These large-cap tech-centric names are led by Apple (which climbed 26% in Q1), Microsoft (up 19%), and Nvidia (up 83%), with each accounting for over 1% of the S&P 500 quarterly return (or roughly half of the S&P 500’s 7.5%). Rounding out the top ten were Alphabet, Amazon, AMD, Broadcom, Meta, Salesforce, and Tesla.

The 2023 rally remains anchored by the biggest stocks at the top of the market — a phenomenon akin to what we observed in 2021. However, as we experienced in 2022, such concentration in a few names lends itself to potential drawdowns and bouts of volatility. 5

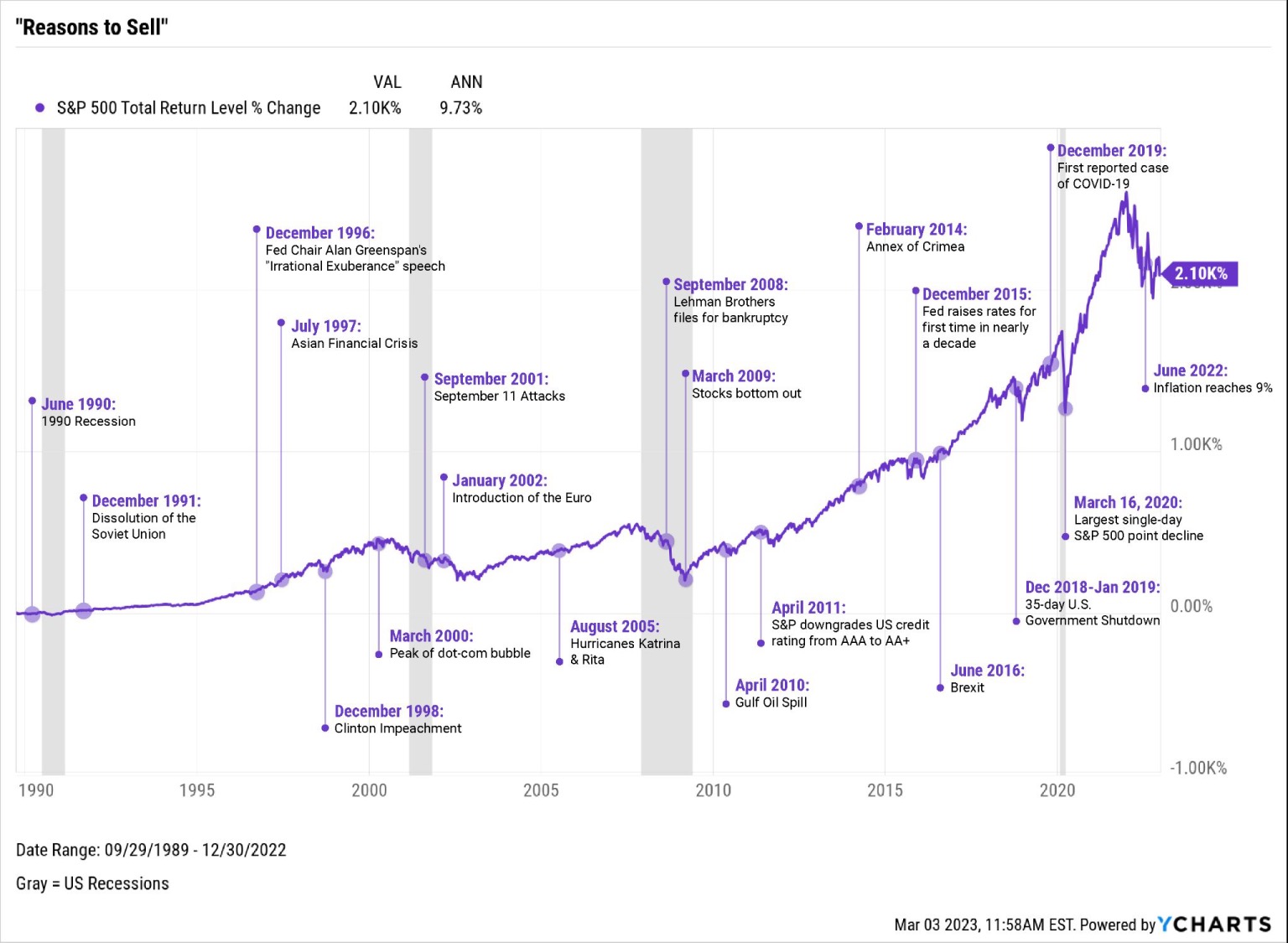

The world is complex and often chaotic, and the resulting market volatility can be unnerving (especially when exacerbated by headlines about persistent inflation, bank runs, and layoffs). However, markets quickly adjust to the news and reflect the risky nature of uncertain outcomes. Therefore, investors are encouraged to stay patient through such market downturns and volatility.

Half of the S&P 500’s best days in the past 20 years have occurred during such markets. Miss just a few of those, and the negative impact on long-term returns can be significant, as the best ten days over the past 20 years accounted for over 75% of the overall return for the period!6

Long-term Investors have historically been rewarded for being willing to patiently bear uncertainty with returns over time (as evidenced by the chart below).

Questions about what market performance means for your portfolio? We can help.