As 2022 draws to a close and you are reviewing your dealership’s financial statements for year-end, it’s important to note several economic trends that are impacting the auto dealership industry. Here are the key trends you’ll want to take into consideration in your planning, as they can significantly affect year-end inventory and taxable income, depending on your chosen tax strategy.

Economic Landscape

Some of the most significant economic landscape trends you should be aware of include:

- Increased interest rates

- Inflation

- Supply limitations, particularly with microchip manufacturers

Keep in mind the large swings in dealership taxes are expected to repeat in the coming year. In addition, most dealers’ Last In First Out (LIFO) Reserves will continue to fluctuate as vehicle inventories recover.

With used inventory value trending downward, you will need to write-down used inventory, which also reduces their taxable income. Individual circumstances will vary more than most years when analyzing year-end financial statements.

Consumer Trends

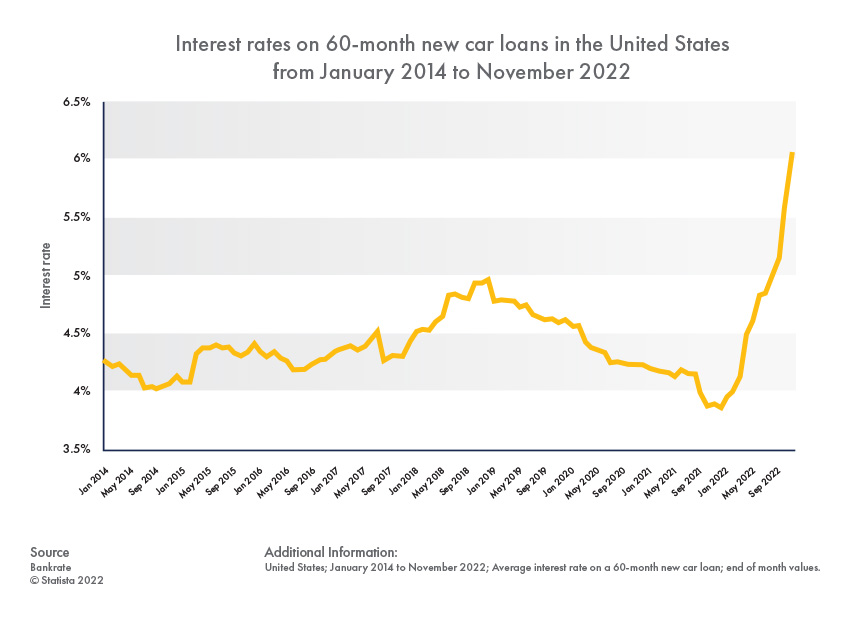

Interest rates for consumers have made a steep rise in the last year. While impacted by other limiting factors, this may have caused some to remove themselves completely from the auto buying market.

Figure 1-Interest rates on 60-month new car loans in the United States – Statistia.com

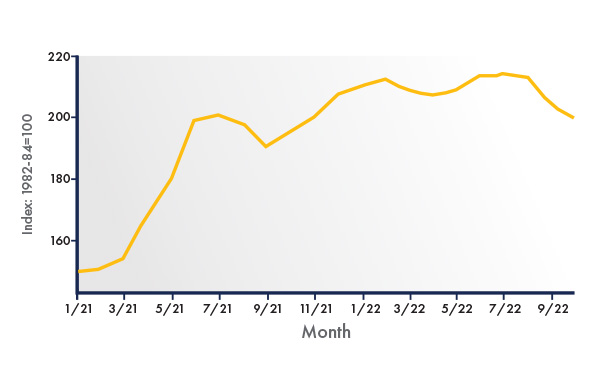

This has begun to affect used car prices as shown in the Consumer Price Index (CPI) inflation numbers. Since the beginning of 2022, used car inflation has fallen 4%, while not making back the 37% rise from 2021. This is still a significant change and may trend further down by the end of the year.

No one can exactly predict what price levels of used vehicles will be at the end of the year, but if your dealership uses a traditional Lower-of-Cost-or-Market (LCM) method for tax purposes, you should be prepared to revalue and write-down anything you have in stock.

Figure 2-CPI: Used cars and trucks in U.S. city average - CUUR0000SETA02 U.S. BLS

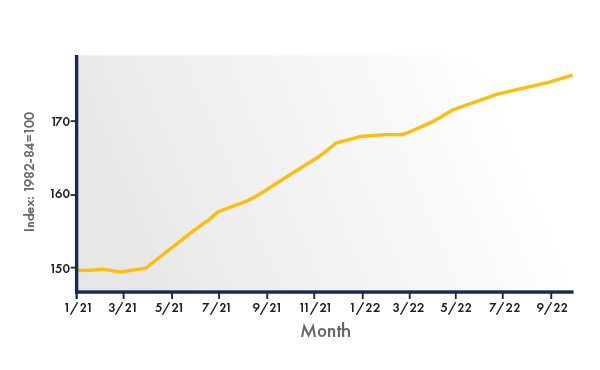

On the other side, the increased interest rates do not appear to have overpowered the supply constraints on new vehicles, with the CPI inflation index for new vehicles in October 2022 being almost 6% higher than the end of 2021.

Figure 3-CPI: New vehicles in U.S. city average - CUUR0000SETA01 U.S. BLS

Year-end planning is vital to the health of your dealership. Accurate reporting for the current year and strategically planning for the coming year will help strengthen your financial position.

New Inventory - LIFO

Remember, in order to maintain LIFO for tax purposes, the IRS requires you to have an adjustment made to your financial books every 12 months. Most dealerships will have made their adjustment last December 2021, so now is the time again if another adjustment needs to be made. If you do not, you will be forced to recapture your LFIO reserves over the next three years and won’t be able to opt back into LIFO for five more years.

Important points to remember regarding LIFO accounting:

- Required to have adjustments on December factory financials

- Changes in inventory levels could mean increase in reserve or more recapture

- Those using the Inventory Price Index Computation (IPIC) LIFO method will likely see deflation, which could mean recapture

- New inventory is up and CPI indexes are high, so those on IPIC may benefit

Used Inventory - LCM

If a dealership uses the LCM inventory method for their used vehicles, they need to do write-downs to get the tax deduction (not just blanket reserves). In addition, from a GAAP perspective, dealers need to do write-downs so they don’t have overstated inventory and an overstated balance sheet.

Many dealers may be out of practice with doing write-downs over the last few years. Or they may struggle with coming to terms they may be getting stuck with. Receiving a tax benefit may help minimize the loss, as well as make for a more accurate balance sheet.

What Does This Mean for Your Dealership?

Even if you chose to recapture all your LIFO reserve last year, as long as you decided to stick with it, the calculation has kept going. Once your inventory returns to where it was, your LIFO reserve is likely to return even bigger than before. This will result in a significant LIFO expense against this year’s taxes, which reduces your taxable income.

In general, most dealerships are seeing an increase in new vehicle inventory over year-end 2021. The exact amount of LIFO expense may be difficult to predict until an actual calculation has been done. To further complicate things, there have been an unprecedented number of new models released this year, as well as multiple price increases for certain models throughout the year.

There are many issues you need to consider when closing out your financial statements for 2022. Partnering with a trusted advisor will help simplify the process and set you up for success for the coming years.

Year-end planning for dealers requires careful accounting based on inventory fluctuation and other economic considerations. Our dealership advisory team can help you find the most advantageous accounting strategy.