The Bureau of Economic Analysis (BEA) requires a survey of foreign direct investment in U.S. businesses every five years. Form BE-12 is the Benchmark Survey of Foreign Investment in the U.S. and applicable for fiscal years ending in 2022.

- The survey is e-filed and due on June 30, 2023, for the 2022 calendar year. Here’s where to e-file.

Required Filers for BEA Survey

A BE-12 report is required for each U.S. affiliate (for each U.S. business enterprise including real estate held for non-personal use) in which:

- A foreign person or entity owned or controlled, directly or indirectly 10% or more of the voting securities of an incorporated U.S. business enterprise

- An equivalent interest of an unincorporated U.S. business enterprise (branch or similar) for fiscal years ending in 2022.

Certain private funds may be exempt. Entities potentially meeting qualified exemptions should review requirements on the BEA.gov website.

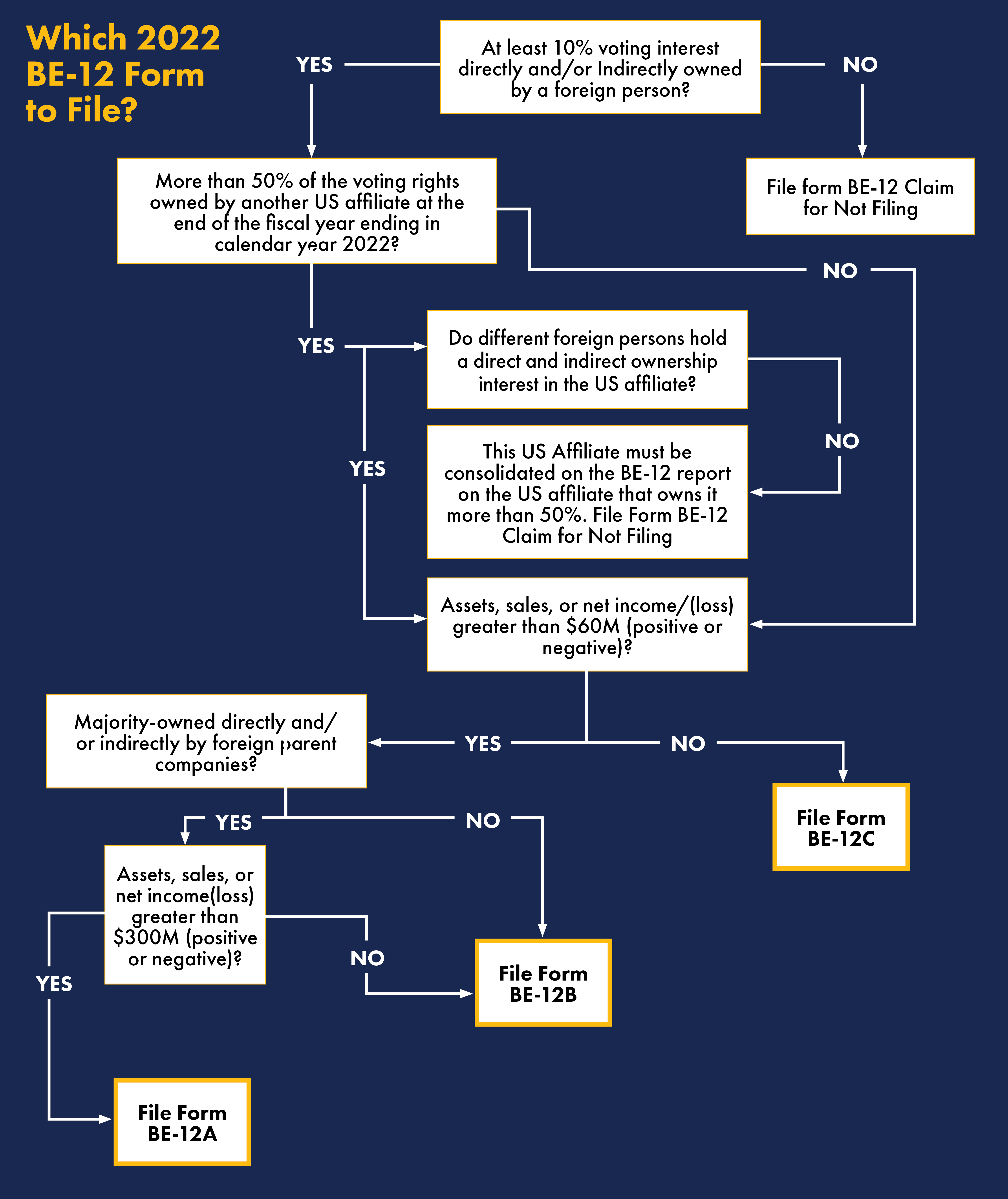

A diagram to assist in determining the filing requirement is below.

All entities meeting the requirements must file, even if the entity is not directly contacted by the BEA. All responses are confidential and protected by federal law.

Filing Deadlines and Requirements

U.S. reporters have until June 30, 2023 to e-file information related to 2022.

Extension Available

Reasonable requests for extension of filing will normally be granted if requested before the due date. An extension can be initiated and approved via e-file or by calling 301.278.9247.

- Penalties for failure to file can reach $50,000, and if the failure to file is willful, $10,000 can be added to the total.

While the BEA may send out Form Series BE-12 to prior BEA filers, failure to receive Form Series BE-12 from the BEA does not relieve any U.S. person from the requirement to file. In addition, if a prior BEA filer, no longer required to file, receives a Form Series BE-12 from the BEA, they must still complete and file Form BE-12-Claim for Not Filing to report the change in status.

Next Steps with BE-12 Reporting

The BE-12 report is electronically filed and requires detailed financial and non-financial information. Therefore, the report is best prepared and filed by the reporting company.

Need assistance with determining whether you have a filing requirement?